Category: Acquisition Finance

Posted on by Fred Wilson & Jason Li

M&A Issues: Consideration

Posted on by Fred Wilson & Jason Li

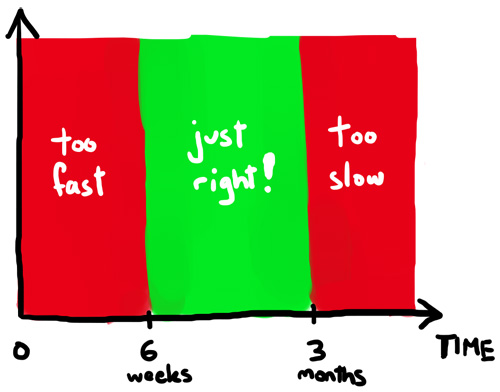

M&A Issues: Timing

Posted on by Fred Wilson & Jason Li

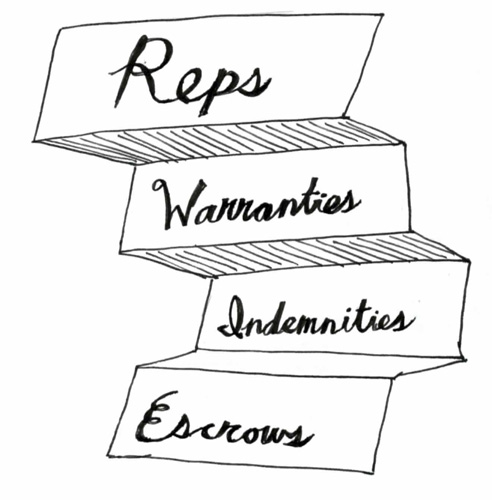

M&A Issues: Reps, Warranties, Indemnities, and Escrows

Posted on by Fred Wilson & Jason Li

M&A Issues: Breakup Fees

Posted on by Fred Wilson & Jason Li

M&A Issues: Governmental Approvals

Posted on by Fred Wilson & Jason Li

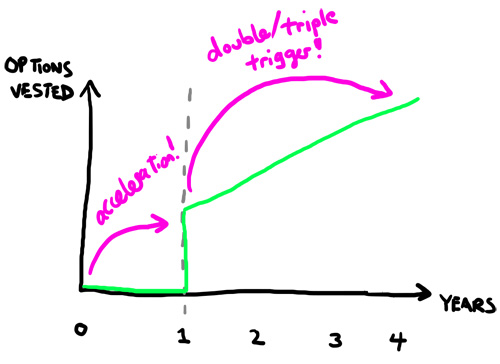

M&A Issues: The Stay Package

Posted on by Fred Wilson & Jason Li

M&A Issues: The Integration Plan

Posted on by Fred Wilson & Jason Li

M&A Case Studies: Feedburner

Posted on by Fred Wilson & Jason Li

M&A Case Studies: WhatCounts Sale Process

Posted on by Fred Wilson & Jason Li